Anna

-

Naakow Grant-Hayford replied to the forum topic IRAN WATCH in the group

International Relations, Politics, Conflict, War & Peace, R2P, Human Rights 12 years, 3 months ago

International Relations, Politics, Conflict, War & Peace, R2P, Human Rights 12 years, 3 months ago

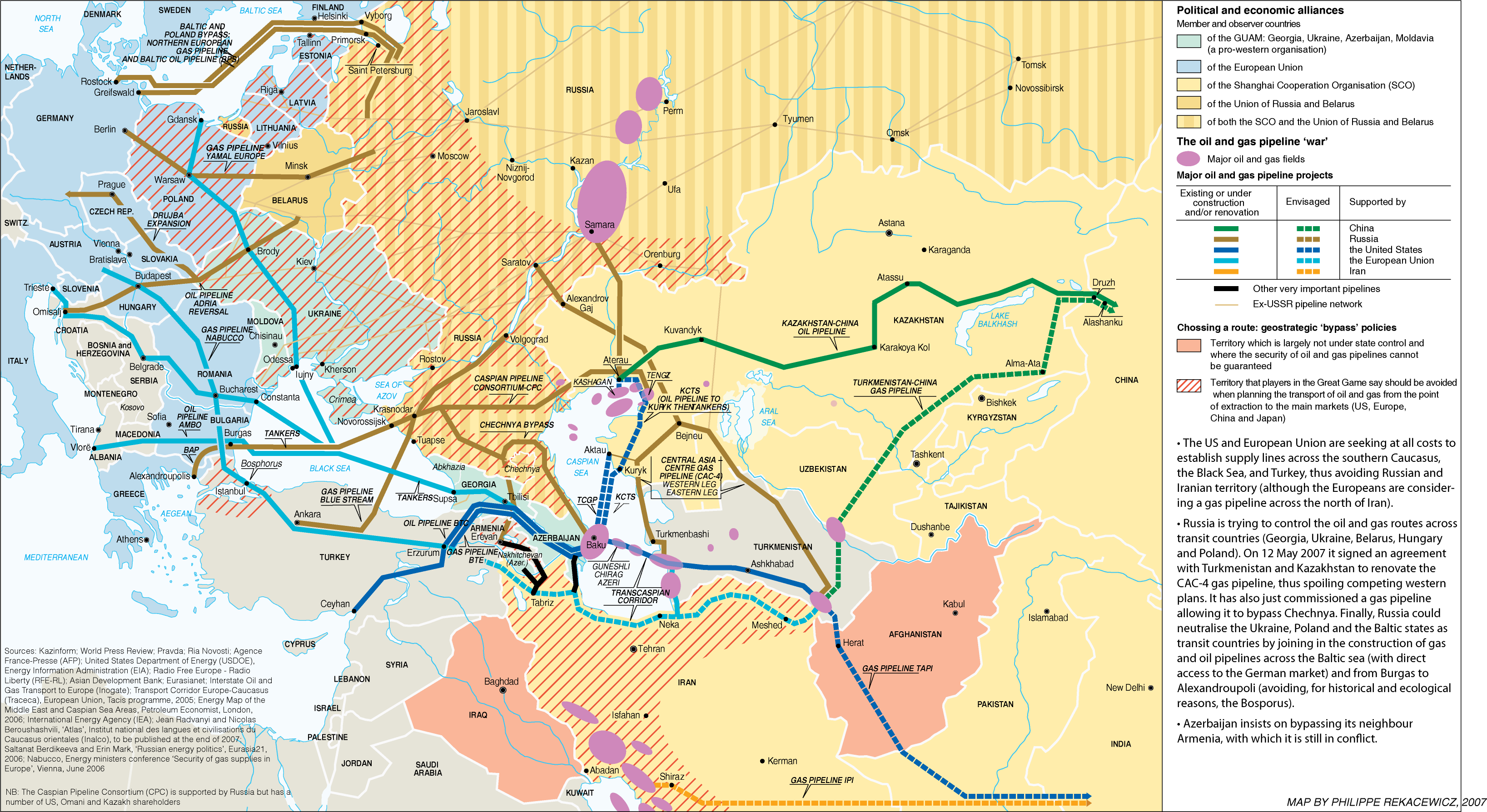

Some Backgorund Material on the Geopolitical Situation of Iran

-

Naakow Grant-Hayford replied to the forum topic Post A Peace Song [with Lyrics :-)] in the group

General Discussion 12 years, 3 months ago

General Discussion 12 years, 3 months agohttp://www.myvideo.de/watch/6847192/Jamiroquai_Too_Young_To_Die

Too young to die Jamiroquoai

Everybody

Don’t want no war,

‘Cos we’re too young to die,

So many people,

All around the […] -

Naakow Grant-Hayford replied to the forum topic Self-reliance by Thomas Sankara (an italian documentary) in the group

African Futures 12 years, 3 months ago

African Futures 12 years, 3 months agohttp://www.youtube.com/watch?v=HvBC7tmgFFM

Sankara – the upright man aka don’t you ever mess with the WEST

-

Naakow Grant-Hayford replied to the forum topic Post A Peace Song [with Lyrics :-)] in the group

General Discussion 12 years, 3 months ago

General Discussion 12 years, 3 months ago“Fragile”

If blood will flow when flesh and steel are one

Drying in the colour of the evening sun

Tomorrow’s rain will wash the stains away

But something […] -

Naakow Grant-Hayford and

Asli Degirmenci Sagbakken are now friends 12 years, 3 months ago

Asli Degirmenci Sagbakken are now friends 12 years, 3 months ago -

Benno Malte Fuchs replied to the forum topic Post A Peace Song [with Lyrics :-)] in the group

General Discussion 12 years, 3 months ago

General Discussion 12 years, 3 months ago -

Benno Malte Fuchs replied to the forum topic Post A Peace Song [with Lyrics :-)] in the group

General Discussion 12 years, 3 months ago

General Discussion 12 years, 3 months agohttp://www.youtube.com/watch?v=YnOoNM0U6oc

Tin soldiers and Nixon’s coming,

We’re finally on our own.

This summer I hear the drumming,

Four dead in Ohio.Gotta get down to it

Soldiers are gunning […] -

Benno Malte Fuchs joined the group

General Discussion 12 years, 3 months ago

General Discussion 12 years, 3 months ago -

Benno Malte Fuchs joined the group

African Futures 12 years, 3 months ago

African Futures 12 years, 3 months ago -

mai abehche valentine and

Dioubate are now friends 12 years, 4 months ago

Dioubate are now friends 12 years, 4 months ago -

Naakow Grant-Hayford and

Silvia are now friends 12 years, 4 months ago

Silvia are now friends 12 years, 4 months ago -

Naakow Grant-Hayford wrote a new post 12 years, 4 months ago

EDITORIAL

by Johan Galtung, 30 Jul 2012 – TRANSCEND Media Service

From Jondal, Norway

Writes Eduardo Porter on The New York Times:

“Perhaps the most surprising aspect of the Libor scandal is how familiar it seems. Sure, for some of the world’s leading banks to try to manipulate one of the most important interest rates in contemporary finance is clearly egregious. But is that worse than packaging billions of dollars worth of dubious mortgages into a bond and having it stamped with a Triple-A rating to sell to some dupe down the road while betting against it? Or how about forging documents on an industrial scale to foreclose fraudulently on countless homeowners?”

A useful summary of the situation as of today. But, a summary of what? What is this? We have been through many answers starting with credit squeeze, then a real estate bubble that burst, toxic assets, credit swaps, hedge funds, derivatives–bets with the money of other people, yours and mine–all finance and banking. A psychologism was added at an early stage; greed. Small savings banks wanted to be in it, the pattern was contagious and spread from Wall Street to the Euro Zone. Bailout vs Stimulus, Wall Street vs Main Street; but as big banks are too big to fail there was bailout for the former and austerity for the latter, with misery. Jobless growth in the USA, 17 percent unemployment in the EU; “stocks slump worldwide and euro sinks as bond rates soar to record” (IHT, 24 July 2012). And so on. And so forth.

Whatever it is, the effect is an enormity. It stands to reason that the causes should be commensurate. True, the system could have reached a tipping edge and tumbled down after one small step–but then that tipping edge is the huge cause. But why didn’t we know about it? Ignorance, sloppy theory? Maybe. But there could be other causes.

See it as bad finance economics and banking practice at work, and the structural violence hitting the old, the poor, the underprivileged is unparalleled since the Great Depression. See it as politics, as intended acts of commission, and it becomes direct violence hitting people whose only wrongdoing was to trust the system.

One hypothesis does not exclude the other. The question becomes, how much was banking gone mad, how much was politics as usual?

One guide in the morass is useful if not perfect: who are the winners, who are the losers. US class warfare, said Warren Buffet, and the rich are winning. Banks that had taken risks with other people’s money and lost billions were bailed out, the victims were foreclosed. Speculation all over, and on basic needs: food, water, housing, education (tuition fees), health services (ever rising costs), well knowing that these are necessities, that the demand is inelastic, people have to buy them at whatever price, hence safe bets.

Speculating on the stock exchange on privatized prisons. When common people do wrong signing a mortgage they cannot service, the court system criminalizes them and the police throw them out of the property. When the fixing, manipulating and betting against their own customers, and rigging the London Interbank Offered Rate-LIBOR is the matter, there are no arrests to prevent destroying evidence and coordinating testimony, but gentle hearings in prestigious places, mild rebukes and milder fines. One may argue that there are no laws clearly defining their actions as criminal. Precisely; but why not, why not right now?

The transfer of capital from investment in the real economy to speculation in the finance economy done digitally, in microseconds, is to a labor-free economy. Workers, the plague of industrial capitalists, quarrelsome, on strike, always demanding more, are out. The longer the buying and selling chains in the finance economy, the more commissions-and hence, “economic growth”-, the fewer jobs. A handful can do it; Lehman Brothers taking huge risks that are compensated by huge Goldman Sachs bonuses.

This was the tipping edge: the transition to the finance economy through deregulation, on credit offered with no capital, on insider trading betting against customers, on buying legislators by financing their campaigns, on Supreme Court judges appointed by bought legislators. Goodbye democracy, welcome finance mogul plutocracy.

The crisis was an opportunity that the rich used to cut whatever smelt of welfare state, privatizing basic needs including health and education (coming). Under no democratic checks & balances control. Using the crisis as a cover for brutal class politics.

If the cause is not yet big enough, an international dimension comes to the rescue. The US empire is threatened militarily by being beaten in one arena after the other; politically, by elites they thought they could trust but that are withdrawing into regional groupings like Latin America and SCO-Shanghai Cooperation Organization; culturally, by the US exceptionalism running out of its magic touch. And economically? By the threats to the Bretton-Woods/International Monetary Fund-IMF system with the dollar as the world reserve currency. Deals are increasingly made in other currencies. Saddam Hussein and Muammar Gaddafi were punished; but to punish China and Russia is more problematic.

The economic goal is to control the global flow of capital via such privatized central banks as the Federal Reserve. Seven not-US-friendly countries had state central banks: Iraq-Iran, Lebanon-Libya, Syria-Sudan-Somalia; they were targeted after 9/11 according to Wesley Clark, the US general who commanded NATO’s attack on Serbia (1997-2000). Libya has already privatized.

But how to manage the Euro zone? By having Goldman Sachs fixing the Greek accounts, and by having GS insiders appointed as interim prime ministers of Greece and Italy and as head of the European Central Bank (who makes money available to the banks at very cheap rates–below inflation?). The name of the game is finance, not real economy, with bailouts, not stimulus; and then the new European Stability Mechanism-ESM treaty of debt, with Article 27: “The ESM, its property, funding and assets…shall enjoy immunity from every form of judicial process”.

Goldman Sachs all over, itself bailed out by the president they bought, Obama, hitting the most US-loyal European countries which would engage in other than US-style policies: Italy-Portugal-Spain-Ireland. The Euro sinks and may implode, the dollar and US bonds survive. Using the crisis as a cover for brutal global politics.

Till one day the US bubbles start busting: the real economy lagging too much behind the finance economy and behind the massive printing of money, and serving people too much behind serving debts. Sacrificing their own people for a world hegemony long since lost. And who will be the winners? The non-West; already taking shape.

______________________

Johan Galtung, a professor of peace studies, dr hc mult, is rector of the TRANSCEND Peace University-TPU. He is author of over 150 books on peace and related issues, including ‘50 Years – 100 Peace and Conflict Perspectives,’ published by the TRANSCEND University Press-TUP.

Editorials and articles originated on TMS may be freely reprinted, disseminated, translated and used as background material, provided an acknowledgment and link to the source, TRANSCEND Media Service-TMS, is included. Thank you. -

mai abehche valentine and

Raphael Dozzi are now friends 12 years, 4 months ago

-

mai abehche valentine and

Naakow Grant-Hayford are now friends 12 years, 4 months ago

Naakow Grant-Hayford are now friends 12 years, 4 months ago -

mai abehche valentine and

Anna are now friends 12 years, 4 months ago

Anna are now friends 12 years, 4 months ago -

Naakow Grant-Hayford posted an update in the group

African Futures 12 years, 4 months ago

African Futures 12 years, 4 months agoMon dieu, qu’est-ce qu’ils sont prolixes les intellectuels francophones. C’est hyper-enervant. Presque 2 heures de ma vie, et pour moi, il n’y’a eu que 5 moments forts dans tout son verbiage. Incroyable.

-

La question que je me pose, c’est celle ci: Penser l’afrique a partir du continent: Je suis d’accord. Il est grand temps. Maintenant: penser le monde a partir de l’afrique ca donnerait quoi? Je pense que c’est une question que nous nous posons assez rarement – sinon jamais. Mais bon. Veuillons voir ou nous menera la reflexion sur le sujet.

-

AFRICA’S PLACE IN THE WORLD

http://ondemand.duke.edu/video/27935/africas-place-in-the-world-con

-

-

Naakow Grant-Hayford created the group

African Futures 12 years, 4 months ago

African Futures 12 years, 4 months ago -

Benno Malte Fuchs and

passant are now friends 12 years, 4 months ago

-

Naakow Grant-Hayford replied to the forum topic Obama: ”Great Speaker, But Kills Little Children” in the group

General Discussion 12 years, 4 months ago

General Discussion 12 years, 4 months agoGood lord now thats one heavy topic to debate. You\’ve started soemthing here.

I\’ll probably comment on this at a latter point. But I didn\’t know you were into Hiphop that much. 🙂

- Load More

![[X]](/img/dialog-close.png)